Shilchar Technologies is a direct beneficiary of industry tailwinds due to its strong market positioning and focused business model. With over 4 decades of experience and 15 years of specialization in distribution transformers for renewable energy and niche industrial applications, the company is well-positioned to capitalize on emerging opportunities.

- About the company

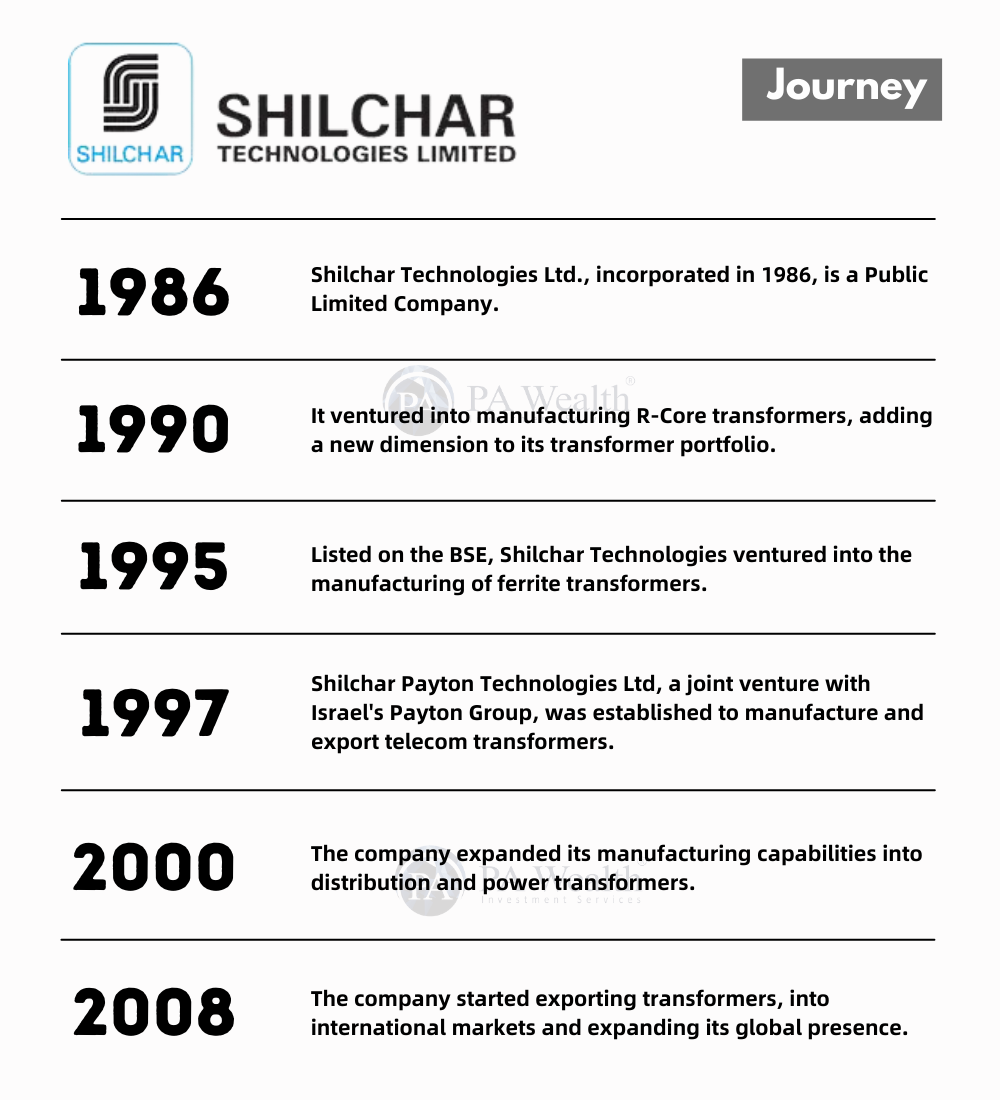

- Journey Since Inception

- Board Members

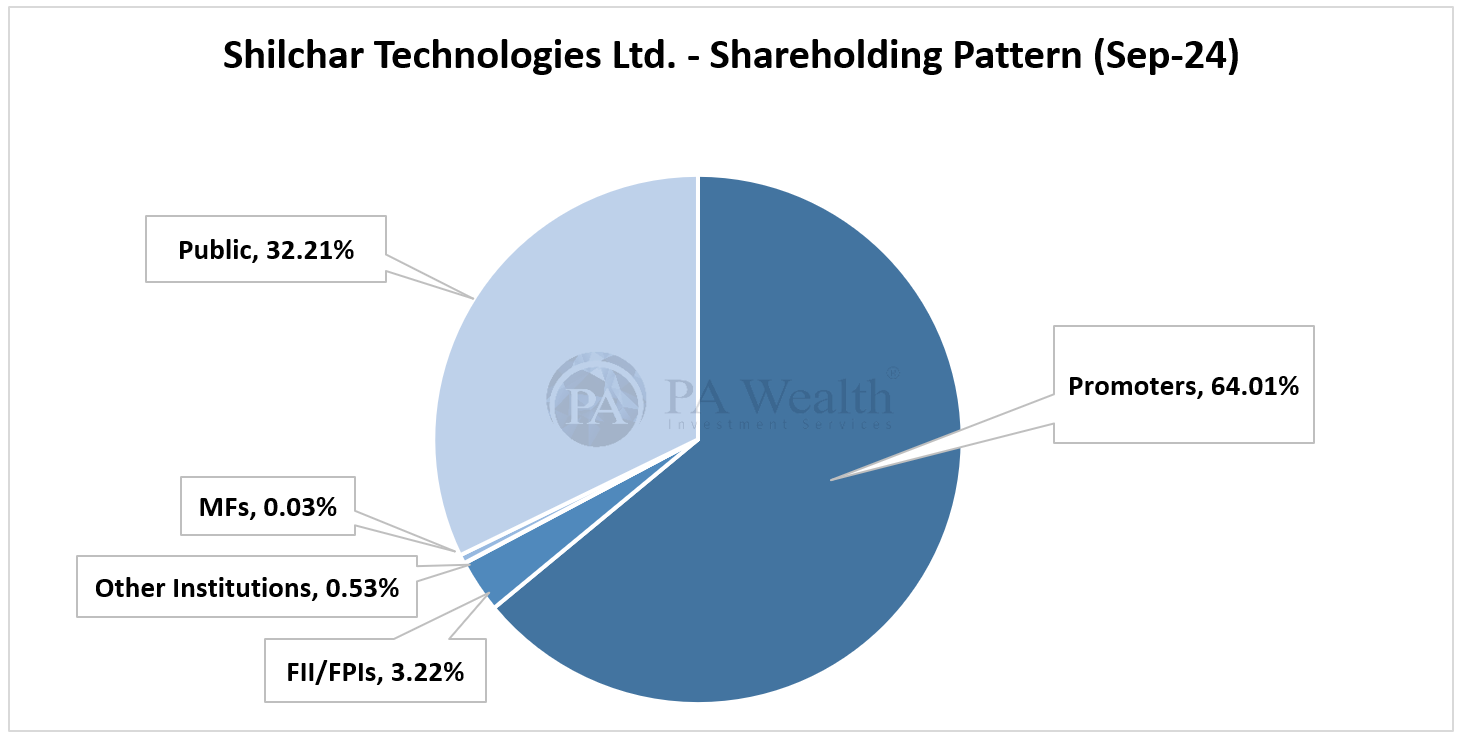

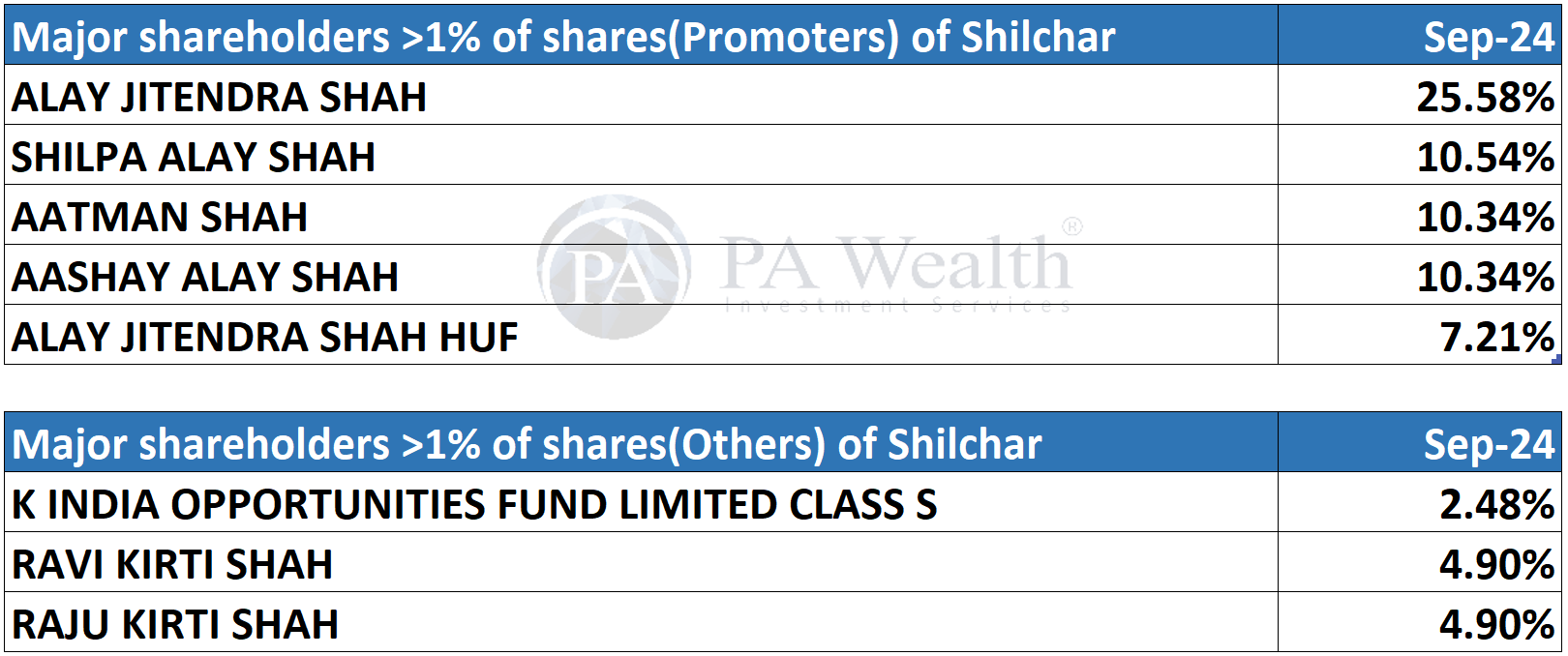

- Shareholding Pattern

- Products

- Revenue Segments

- Cost Structure

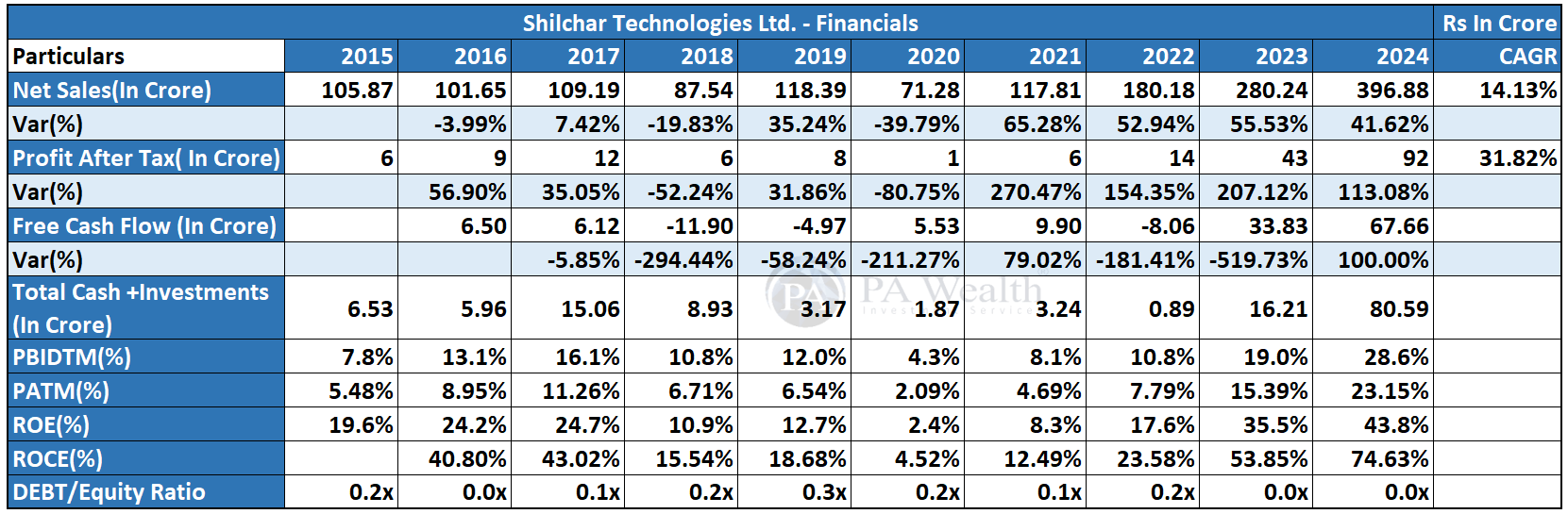

- Financial Parameters

- Management Key Highlights

- Concall Highlights

- Strengths & Weaknesses

(A) About

Shilchar Technologies Limited, established in 1986, is a leading Indian manufacturer of Electronics & Telecom and Power & Distribution transformers. The company entered the R-Core transformers segment in 1990 and, following strong market demand, began producing Ferrite transformers in 1995. The Company has expanded its operations to include the manufacturing of Distribution and Power Transformers between 2004-07.

Today, the company serves a wide range of industries, including utilities, the renewable energy sector, and retail customers worldwide. Its product range includes transformers with capacities up to 50 MVA and voltage levels up to 132 KV, serving various industrial needs.

(B) Journey of Shilchar Technologies Ltd.

(C) Board of Directors of Shilchar Technologies Ltd.

(D) Shareholding Pattern of Shilchar Technologies Ltd.

(E) Product Portfolio

(i) Power Transformer

Shilchar Technologies has been producing Power Transformers since 2007. With the launch of a state-of-the-art manufacturing facility in April 2020, the company has expanded its capabilities to manufacture transformers ranging from 5 MVA to 50 MVA with voltage ratings up to 132 KV. Up to 4000 MVA of transformers can be manufactured annually.

(ii) Distribution Transformer

Shilchar Technologies Ltd has been manufacturing distribution transformers since 2004 and has expanded its capacity to manufacture transformers ranging from 100 KVA to 5 MVA with voltage ratings up to 33 KV.

(iii) Renewable Energy transformers

Shilchar Technologies developed Inverter Duty Transformers (IDTs) for solar applications in 2011. The company has type-tested 3, 4, and 5-winding transformers with copper and aluminium conductors, with a maximum rating of 12.5 MVA. Shilchar has supplied around 4 GWs of transformers globally, including to the Philippines, Egypt, Kenya, and Chile.

Shilchar Technologies has been manufacturing generator transformers for windmills since 2006, supplying 3.5 GW of transformers by March 2020. These include aluminium and copper foil windings, with various transformers type-tested for windmill applications.

Shilchar has manufactured Generator transformers for more than 100 MW of Hypro projects up to March 2020.

(iv) Furnace Transformer

A furnace transformer is an electrical component that steps down high voltage to a lower, safer voltage for use by the furnace. This enables the furnace’s components, such as the thermostat and ignition system, to function efficiently. Furnace transformers, are used in electric furnaces that melt and refine materials. They are commonly employed in industries like cement and mining, where there are high current requirements.

(F) Revenue Segments of Shilchar Technologies Ltd.

Shilchar Technologies Ltd. has demonstrated a steady shift towards export-driven revenue over the years. Export contribution increased from 24% in FY20 to 52% in FY24, reflecting a strategic focus on international markets.

(G) Cost Structure of Shilchar Technologies Ltd.

(H) Financials of Shilchar Technologies Ltd.

The company’s revenue grew at a 14.13% CAGR, from ₹105.87 Cr. in FY15 to ₹396.88 Cr. in FY24. PAT increased from ₹6 Cr. to ₹92 Cr. at a 31.82% CAGR, while ROE rose from 19.6% in FY15 to 43.8% in FY24.

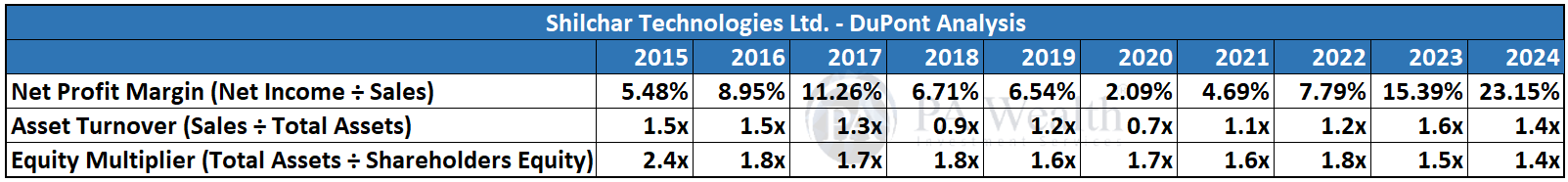

DuPont Analysis

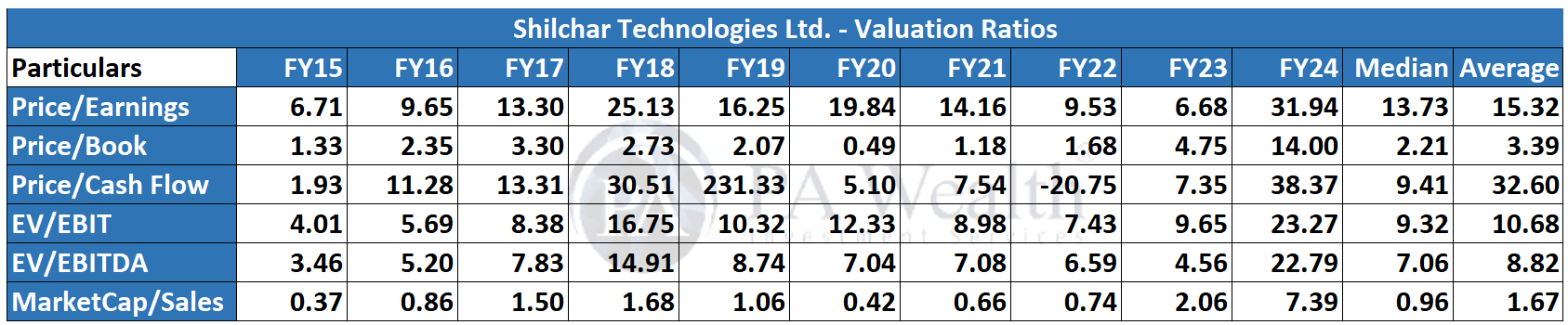

Valuation Ratios

(I) Management Discussion

Outlook

India transformer industry

- Government initiatives for grid infrastructure upgrades, the rapid growth of renewable energy, particularly in the solar sector, and an improved capital expenditure outlook from both public and private sectors are key drivers of rising transformer demand. These factors collectively support the strong growth trajectory of the industry.

- Transformer demand in India is rising due to the surge in solar capacity, from 15 GW to 50 GW annually, and Power Grid Corporation of India’s plans to double investments in grid modernization.

- The transformer market is benefiting from higher capital expenditure in steel, cement, data centers, and green energy adoption, boosting growth prospects.

- Global supply shortages, especially in the U.S. and Europe, are creating strong export opportunities for Indian transformer manufacturers. Aging infrastructure, renewable energy growth, and supportive government policies in Western countries will drive continued growth in India’s transformer market.

India power sector

- Electricity demand in India rose by 7.4%, reaching 1,626 billion units (BU), with peak demand hitting a record 243 GW, a 13% year-on-year increase. This significant growth, especially the peak demand recorded in September 2023, highlights the changing energy consumption trends in the country.

- Irregular monsoon rainfall led to a 17% drop in hydroelectric generation. The government responded with coal blending mandates and full-capacity operation of coal plants, while states announced new thermal capacities to meet growing electricity demand.

- The electric vehicle (EV) sector grew significantly in 2023, with sales surpassing 1.5 million units, a 49% YoY increase. Furthermore, the government’s approval of the “PM – eBus Sewa” program to deploy 10,000 electric buses nationwide underscores the continued push for transportation electrification.

Renewable energy sector

- In FY24, India’s renewable energy sector grew significantly, with its share of total capacity rising from 22% (78 GW) in FY19 to 33% (144 GW), and its contribution to electricity generation increasing from 9% to 13%.

- In 2023, India auctioned 22.9 GW of renewable capacities, more than double the previous year, driven by a 70% increase in solar and 24% rise in complex bids. This trend continued in early 2024, with complex bids making up nearly 50% of auctions.

- India’s push for net-zero by 2070 has increased the demand for energy storage solutions. Following the government’s April 2023 guidelines, progress in Pumped Storage Plants (PSP) and Battery Energy Storage Solutions (BESS) surged, with states and private players announcing involvement.

(J) Concall Highlights

- India’s power consumption is set to grow substantially, with peak electricity demand projected to exceed 270 gigawatts by 2026 and surpass 500 gigawatts by 2035.

- The company aims to achieve a revenue of ₹550 crores in FY24-25, with plans to fully utilize its new capacity by FY26.

- Export demand is rising due to investments in the modernization of aging grid infrastructure in Western markets.

- There are challenges with importing CRGO (Cold Rolled Grain Oriented) laminations due to the need for BIS (Bureau of Indian Standards) approvals, but the material is still available, and the company is not having any sourcing problems.

- Onboarding and training new talent to meet the operational requirements of the expanded capacity.

Capex

- The company expanded its production capacity from 4,000 MVA to 7,500 MVA in August 2024, boosting production levels in September and driving strong YoY and QoQ growth in Q2, showcasing its ability to meet rising market demand.

- The company plans to fully utilize its expanded production capacity in the second half of FY25 and targets a turnover of ₹750-800 crores for FY26.

- A large land parcel at Gavasad, with two-thirds reserved for future expansion, offers long-term growth potential. As brownfield expansions, capacity can be built quickly to meet industry demand.

(K) Strengths & Weaknesses

Strengths of Shilchar Technologies Ltd.

(i) Established track record of operations: Shilchar Technologies Ltd, with over 20 years of experience, leads India’s renewable energy sector and exports to markets like the USA, Canada, the Middle East, and Africa. It manufactures transformers ranging from 5 KVA to 50,000 KVA, with 60% of revenue from the power and energy sector. ISO 9001-2015 and BIS certified, the company’s NABL-accredited testing lab in Vadodara highlights its commitment to quality. It is also expanding into the steel and cement industries.

Weaknesses of Shilchar Technologies Ltd.

(i) Raw material volatility and forex fluctuation risk: Shilchar Technologies Ltd.’s main raw materials—copper, transformer oil, CRGO steel, and aluminium—make up 80-85% of costs, with price volatility due to global demand and forex fluctuations. CRGO steel is imported, adding price instability. The company mitigates this risk by purchasing materials on order. In FY24, 50% of revenue came from exports, with minimal direct imports. While not actively hedging, the company reported a foreign exchange gain of ₹2.64 crore in FY24, slightly lower than ₹2.81 crore in FY23.

(ii) Liquidity: Shilchar Technologies Ltd. has a strong liquidity position but relies heavily on non-fund-based working capital, with utilization increasing to 88% in FY24. While cash flow remains healthy, the minimal use of fund-based limits suggests limited working capital flexibility. The company’s operating cycle improved to 79 days but still lags behind peers, with receivables management as a key focus. Additionally, the absence of long-term debt obligations in FY25-FY27 may restrict growth opportunities through debt financing.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

Great I formation and detailed analyses.