Will Atul Ltd be able to maintain its past performance? – Quarter 1 FY23 Highlights

Atul Ltd Life Science Chemical and Performance & Other Chemical segment grew by 37.5% and 37.6% respectively in Q1FY23 as compared to Q1FY22.

The Complete Guide to Understanding Bearings Industry

The Indian Bearing market expected to grow from USD 1.8 Bn (2021) to USD 3.4 Bn (2027) at a CAGR of 10.9% during 2021 to 2027.

Cummins India Ltd – Diesel Engine Producers

Cummins has Strong Presence in Power Genset Industry. The segment is on strong path of recovery focusing on enhancing current products, particularly in medium and high horsepower (HP) range. Further, Power Generation Business is mainly dependent on demand from data center, manufacturing, pharma, healthcare, commercial reality.

Suprajit Engineering – Leader in Automotive Cables

The market leader in Automotive Cables with a ~75% market share in 2W OEMs.

~59% of Revenue was contributed by Auto Cable Business. However, Under Auto Cable Business 2W (OEMS) has contributed a share of 48% and 18% by 4W (OEMs). Whereas, 18% has been contributed by Domestic Aftermarket and rest 18% contribution by 18% Export OEMs.

Timken India – Consistent compounder of Auto Ancillary Industry

Timken India is Subsidiary of The Timken Company which is a global industrial leader with a growing portfolio of engineered bearings and power transmission product brands.

Bharat Forge Ltd – Market leader in components of PVs and CVs

Leadership position in CVs engine and chassis components segment; strong customer base in domestic nd international markets facilitated by strategic acquisitions

Uno Minda Ltd – Largest Switch Player in India

It is the largest manufacturer of switches, alloy wheels and horns in India with a total market share of 67%, 45% and 50% respectively. Meanwhile, in Air Bags it has 25% and in lights, it has 20% of the total market share.

Asian Paints: India’s Largest Paint Company

85% of Revenue comes from decorative business which is key segment of Asian Paints. In Fact, the Company is the Market leader in the decorative space of the Total Decorative industry.

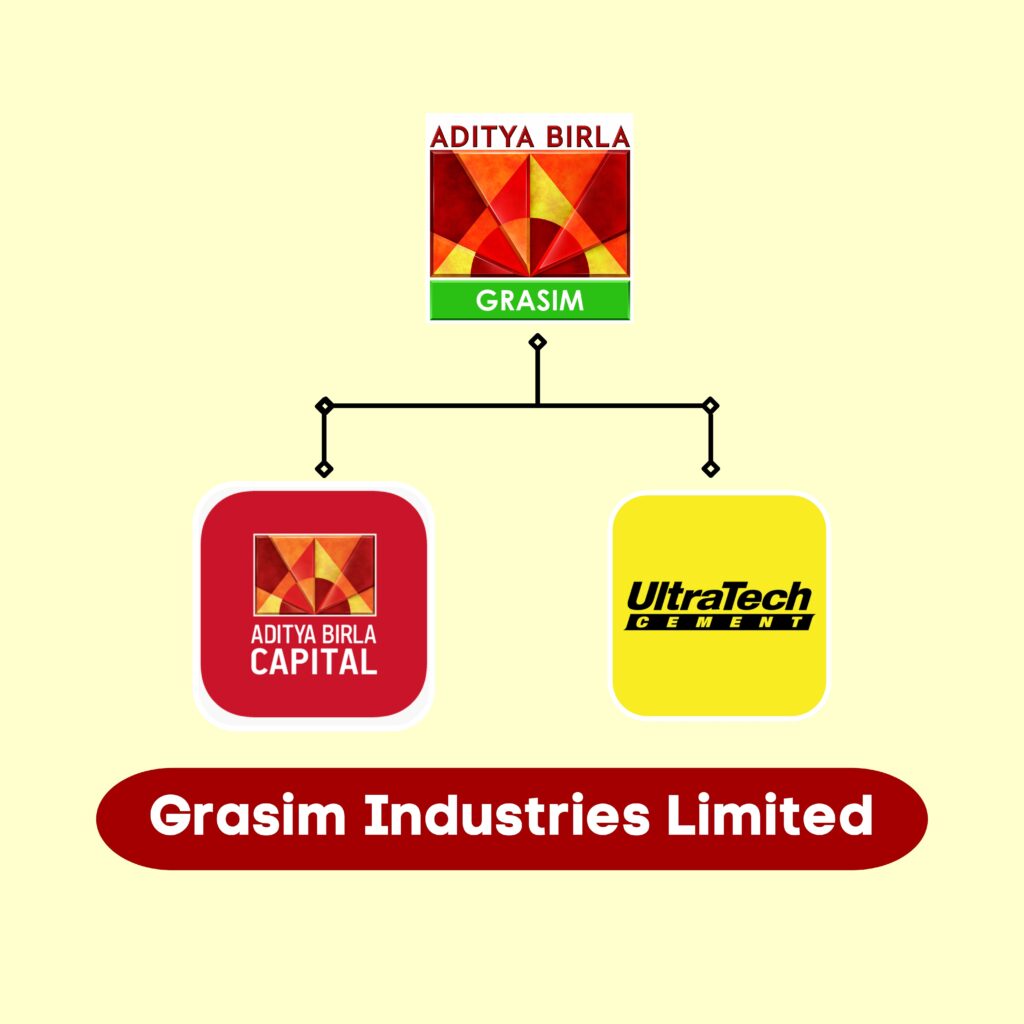

Grasim Industries: Diversified Businesses & Largest Viscose Manufacturer

Grasim Industries Ltd, is a flagship company of the Aditya Birla Group. Incorporated in 1947, it started as a textiles manufacturer in India.

Growth Outlook of Indian Diagnostic Chains

The Market size grew to ~₹730bn with 17% Market Share of organized diagnostic chains in FY21. Moreover, it is expected that the market will grow to ₹980 bn from FY21-FY23 with 14-16% of CAGR.