- What are International Mutual Funds?

- Types of International Funds

- Advantages of International Mutual Funds

- Key Risks Associated with International Mutual Funds

- Things to Consider Before Investing

International mutual funds give investors access to worldwide markets, allowing them to diversify their portfolios beyond domestic investments. These funds aggregate money from different investors and invest in securities issued by companies based outside of India. These offer investors a chance to diversify their portfolios and access opportunities beyond their domestic markets.

What are International Mutual Funds?

International mutual funds are investment vehicles that pool money from multiple investors and invest in securities from markets other than the investor’s home country. These funds can target specific areas, countries, or worldwide markets, offering exposure to overseas stocks, bonds, and other assets.

Types of International Funds

There are several types of international funds available in India, each with a unique approach to global investing:

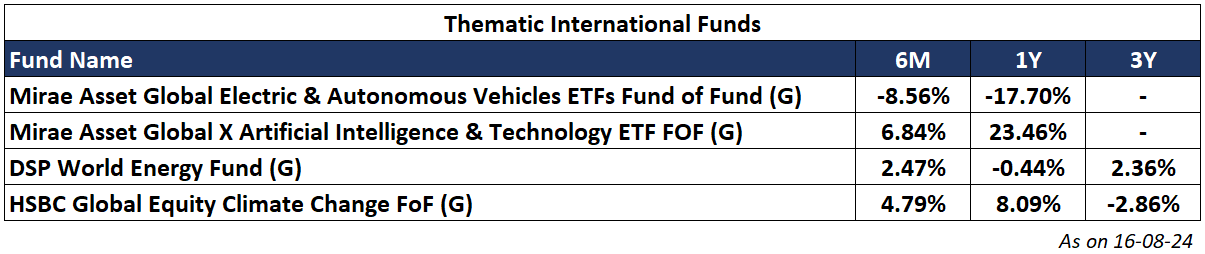

(i) Thematic International Funds: These funds take a theme-based investing approach. For example, an international thematic fund may invest in the equities of overseas companies involved in technology, healthcare, or green energy. The emphasis is on a certain theme, regardless of geographical location.

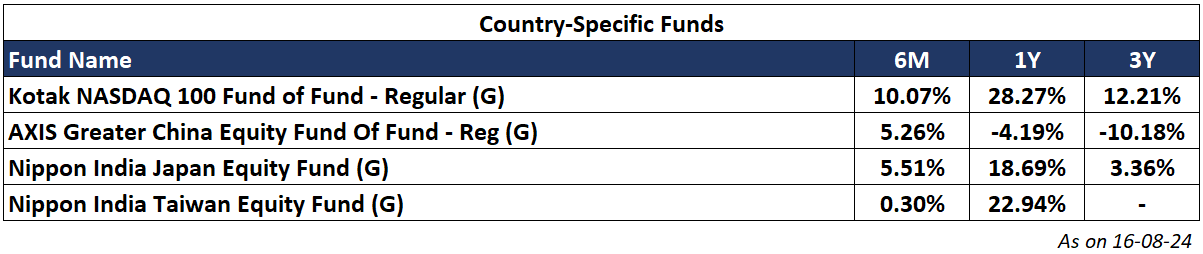

(ii) Country-Specific Funds: These funds invest in companies from a specific geographic area or country. For example, a fund may concentrate on Asia, Europe, or a specific country, such as Japan or Brazil. The goal is to capitalize on the economic opportunities and growth potential of that specific region or country.

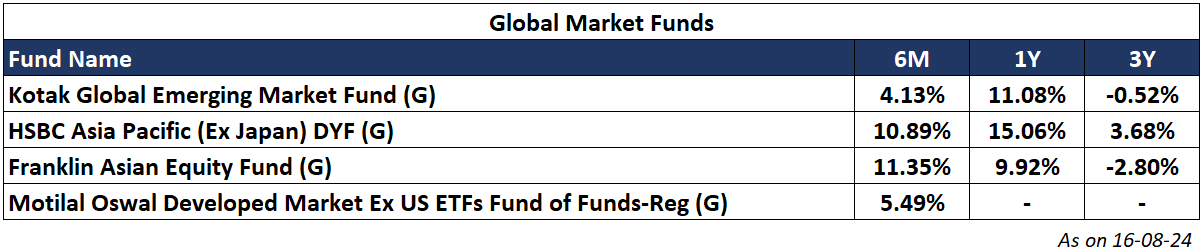

(iii) Global Market Funds: Unlike region or country-specific funds, global markets funds invest in a diverse portfolio of companies from all over the world. These funds reduce risk by diversifying investments around the globe so that strong performance can offset bad performance in one area.

Advantages of International Mutual Funds

Geographic Diversity

The main advantage of international mutual funds is diversity. By diversifying your investments across regions and economies, you may greatly mitigate the impact of market changes in any one region.

- Hedging against Domestic Market Volatility: International funds can serve as a cushion against downturns in the Indian economy. When the home market underperforms, other worldwide markets may flourish, preserving your whole portfolio.

- Exposure to global growth opportunities: Different economies run at varying speeds. Subsequently, Investing globally allows you to benefit from the development potential of rapidly emerging economies.

Access to Global Market Leaders

Many of the world’s most innovative and profitable enterprises are based outside of India. International mutual funds are an easy method to obtain exposure to these global titans.

- Investing in global powerhouses: You can own a piece of well-known corporations such as Apple, Google, Microsoft, or Amazon that are not listed on Indian stock markets.

- Participation In Global Trends: Investing in international funds allows you to capitalize on global trends and technical breakthroughs that may not be completely represented in the Indian market.

Key Risks Associated with International Mutual Funds

- Currency Risk: Changes in exchange rates might affect the performance of international funds. A weaker rupee can improve rupee returns, while a stronger rupee can result in poorer returns.

- Market Risk: Economic difficulties, political instability, and geopolitical events can all contribute to international markets being more volatile than Indian ones.

- Country Risk: Investing in specific countries increases the risk of economic or political upheaval, which can harm the fund’s performance.

- Liquidity Risk: Some international funds may have lesser liquidity than domestic funds, making it difficult to exit your investment promptly.

- Higher expense ratios: International funds frequently have higher expense ratios due to the extra costs associated with managing investments in international markets.

Things to Consider Before Investing

- Investment Horizon: International investing often necessitates a long-term approach. Short-term changes in market prices might be exaggerated, and the benefits of diversification may take several years to fully realize.

- Risk Tolerance: Evaluate your risk tolerance carefully. Currency fluctuations and market volatility are two elements that often increase the risk of international funds when compared to local funds.

- Diversification: International funds should be regarded as part of a more comprehensive investing portfolio. Diversification across asset classes and geographical locations can help to control overall risk.

- Research: Investigate the fund’s investment objectives, performance history, expense ratio, and experience of the fund management. Take note of the fund’s regional concentration, investment strategy, and currency hedging techniques.

- Consult a financial advisor: Seek counsel from a knowledgeable financial advisor to better understand your personal financial goals and risk tolerance. A financial advisor can help you determine the suitability of overseas funds for your portfolio and give continuing counsel.

Investing in international mutual funds can help diversify your portfolio and provide access to global growth prospects. However, it is critical to be aware of the related dangers and undertake extensive research before making investing selections.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | AMFI registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore