- What are Thematic Funds?

- How do Thematic Funds work?

- What are the Benefits of Investing in Thematic Funds?

- Who Should Invest in Thematic Funds?

- Things to Consider Before Investing in Thematic Funds

- Taxation on Thematic Funds

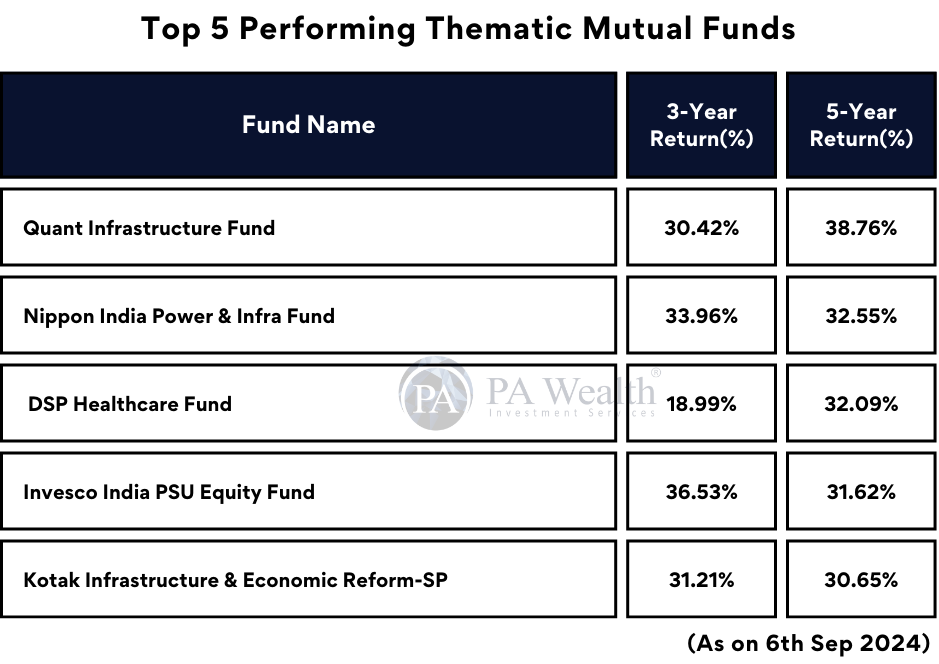

- Top 5 Performing Thematic Mutual Funds

In the vast landscape of mutual fund investments, thematic funds stand out as a unique opportunity for investors seeking to align their portfolios with specific trends and themes shaping the market. These funds offer a targeted approach by investing in companies united by a common theme, which sets them apart from traditional investment strategies based on market capitalization, style, or sector.

What Are Thematic Funds?

Thematic funds are a category of mutual funds that focus on investing in companies related to a specific theme or trend. These themes can range from broad concepts such as sustainability and technological innovation to niche areas like healthcare advancements or demographic shifts. Unlike conventional funds that diversify across sectors or market caps, these funds concentrate their investments around a central idea or trend, providing investors with exposure to companies poised to benefit from that theme’s growth.

How do they work?

All mutual funds derive their returns from underlying assets. For large-cap funds, these assets are stocks of India’s largest companies by market capitalization. In contrast, thematic funds invest in stocks of companies connected by a specific theme.

For example, an ESG-themed fund invests in companies excelling in environmental, social, and corporate governance aspects, spanning various sectors like technology, financial services, FMCG, and consumer durables.

Thematic funds differ from conventional investment strategies that focus on market capitalization (large-cap, mid-cap, small-cap), style (value and growth), or sectors (pharma, technology, infrastructure). These funds invest across different sectors and market caps as long as they align with the theme. Additionally, SEBI mandates that at least 80% of a thematic fund’s total assets must be invested in equity and equity-related instruments related to the specific theme.

Benefits of Investing

Diversification: These funds provide diversification across sectors, reducing the risk associated with investing in a single industry. This broad exposure shields the portfolio from underperformance in any particular sector.

Potential for High Returns: Successful identification of a lucrative theme can lead to market-beating returns. However, it requires diligent research and monitoring to capitalize on emerging trends effectively.

Who Should Invest?

These funds are suitable for investors who possess a high-risk appetite, a long-term investment horizon, and a keen understanding of various sectors related to the fund’s theme. These investors should be willing to withstand market fluctuations and exercise patience as thematic themes often take time to materialize into profitable investments.

Things to Consider Before Investing

Before committing to these funds, investors should assess their investment goals and risk tolerance. It’s crucial to understand that these funds carry higher risks due to their focused nature and may require a longer investment horizon to realize substantial returns. Additionally, investors should be mindful of expenses such as the fund’s expense ratio, which can impact overall returns.

Taxation

Taxation on these funds follows the standard capital gains tax structure. Short-term capital gains (STCG) arising from investments held for less than one year are taxed at 20%, while long-term capital gains (LTCG) on investments held for more than one year are taxed at 12.5% on gains exceeding 1.25 lakh in a financial year.

Top 5 Performing Thematic Mutual Funds

In conclusion, while thematic funds offer an enticing avenue for investors to capitalize on emerging trends and themes, they require careful consideration and a thorough understanding of the associated risks and tax implications. By aligning investment goals with thematic strategies and maintaining a disciplined approach, investors can potentially reap rewards from this dynamic segment of the mutual fund market.

Drop us your query at – info@pawealth.in or Visit pawealth.in

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore