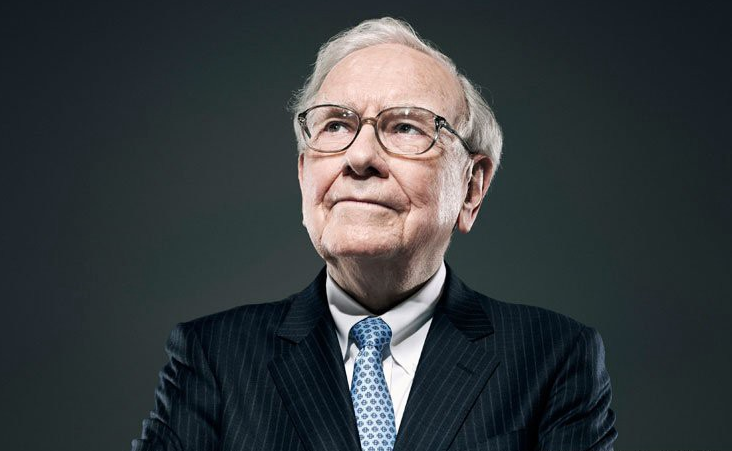

We all know about the Ace Investor Warren Buffett, who is the God Father of Stock Market.

Warren Edward Buffett - Born in Omaha city belonging to Nebraska State of the US. Warren Buffet has been the chairman and largest shareholder of Berkshire Hathaway since 1970. Mr Buffett also owns companies such as See’s Candy Shops, the Buffalo News, and World Book International.

Moreover, He holds major positions in companies such as American Express; Capital Cities/ABC (now Disney); Coca-Cola; Gannett; Gillette; and the Washington Post.

Even the Cluster of EV Batteries which is very popular these days; Mr Buffett identified one of that companies under this segment 12 Years ago.

So, we can assume that how Warren Buffett thinks and manage his thought to benefit his wealth.

Lessons from Warren Buffett

(i) Invest in What you understand

Warren Buffet explains investor should always invest in such business, which is easy to understand and have a some level of certainty.

Example : If an investor is going to buy a particular stock they must know that he is not only buying stock but also buying their business.

Moreover, In May 2018, Buffett criticized Bitcoin buyers for “just hoping the next guy pays more” for an asset without intrinsic value. ”You aren’t investing when you do that, you’re speculating.”

(ii) Owner Mindset

As a long-term Investor, He believes whenever an investor infuses his money in any stock/company, he should always keep in mind that he is going to invest with owner mindset. Owner Mindset will help the investor to stay and hold business for longer horizon.

Example : Berkshire Hathaway acquired 887mn shares or 5.4% stake in Apple between 2016 and 2018 amounting $36 billion. This is now more than $160 billion worth.

Apart from that in an interview, Mr Buffett told "I don’t think of Apple as a stock. I think of it as our third business"

(iii) Keeping Simple - Warren Buffett

Mr Buffett believes investors should invest in a business that even a fool can run, because someday a fool will. However, here foolish means, a business which involved very less complexity.

Many peoples are not aware about investments, so if you are uncomfortable with the asset class that you have picked, then most probably you will also panic when other will panic in any uncertain happenings.

Eventually, to overcome the uncertainty investor should always look for simpler things.

(iv) Time is Important in the Market, Instead of Timing the Market

Here, Buffett says “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.” He had also said, “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

Timing The Market describes the speculative strategy of trying to time one’s trades based on predictions about future market movement.

So don't ever try to go beyond the market, because market is supreme and uncertainty will always be there.

(v) Too Much Diversification is not Healthy

Buffett tells that, investor must avoid of over diversifying the portfolio. He says, do you have the time to keep on top of dozens of companies in your portfolio? Answer would be "No".

The average person simply cannot pay enough attention to a broad spectrum of stocks in a variety of industries and/or asset classes.

Mr. Buffett believes emphatically that the only way to consistently outperform the broad market is to focus one’s money on a few really good companies that are on sale.

(vi) Don't borrow to Buy Stocks

Buffett built his wealth by getting interest to work for him — instead of working to pay interest, as many Americans do.

In a 1991 Speech at University of Notre Dame, He said -

“I’ve seen more people fail because of liquor and leverage — leverage being borrowed money.

He also said “You really don’t need leverage in this world much. If you’re smart, you’re going to make a lot of money without borrowing.”

(vii) Don't Put All eggs in one Basket

Warren Buffett teaches, investors should never put his money in one asset class or business. The philosophy is to explain risk appetite of an investor.

Investors and financial professionals diversify their holdings by investing money in a variety of different investments. This gives them a cushion against risk.

Investor must remember, Within stocks, they can pick companies that have different sizes, different products, different industries, and different regions that can create edge over its portfolio.

(viii) Keep Surplus Cash

In 1973, Buffett made one of his most successful investments ever in the Washington Post.

At the time, the Post was widely regarded to have a value somewhere between $400M and $500M — though its stock ticker put it at only $100M. That was, for Buffett, a signal to buy. For just $10M, he was able to acquire more than 1.7M shares.

The underlying philosophy here is simple: hold onto your money when money is cheap, and spend aggressively when money is expensive.

(ix) Investment banker incentives are usually not your incentives

While Buffett and Berkshire Hathaway conduct plenty of business with investment banks and have invested in a few, he has issued some pointed criticisms at the industry over the years.

His main problem with investment bankers is that their financial incentive is always to encourage action (sales, acquisitions, and mergers) whether or not doing so is in the interest of the company initiating the action.

(x) Be fearful when others are greedy, and greedy when others are fearful

In uncertain times, Mr Buffett believes that savvy investors should continue looking at the fundamental value of companies, seeking companies that able to sustain their competitive advantage for a long time.

However, If investors can do that, they’ll naturally tend to go in the opposite direction of the herd — to “be fearful when others are greedy and greedy only when others are fearful,” as he wrote in 2004.

By piling cash into distressed American companies like General Electric, Goldman Sachs, and Bank of America during the 2008 financial crisis, Buffett reportedly made $10B by 2013.

See more stock updates - Click to Know

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: News Publications, Interviews, Industry’s Publications.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore