Carnelian Capital Compounder Strategy follows a QGARP approach, investing in quality, scalable businesses at reasonable valuations to drive sustainable wealth creation and superior risk-adjusted returns by maintaining a concentrated portfolio across large, mid, and small-cap companies with proven track records and capable management.

- About

- Basic Details

- Investment Strategy

- Classification Portfolio of the fund

- Fund Managers & Tenure of Managing the Scheme

- Investment Details

- Returns Generated

- Risk Metrics

- Taxability of Earnings

(A) About the Carnelian

Carnelian Asset Advisors LLP, a boutique investment management firm founded in April 2019, manages USD ~1.3 billion. It aspires to build a best-in-class asset management platform renowned for its values, expertise, and best practices. Specializing in Indian equity investments, Carnelian caters to HNIs, family offices, institutions, and partners’ own capital across diverse strategies, market caps, and sectors. Its PMS emphasize long-term wealth creation through a research-driven approach focused on quality businesses, capital preservation, and compounding.

(B) Basic Details of Carnelian Capital Compounder Strategy

| Fund Structure | Discretionary PMS |

| Launch & Start Date | May, 2019 |

| Type | Open-ended |

| AUM | ₹640 Cr (As on 31st Jan, 2025) |

| Strategy | Multicap |

(D) Investment Strategy

- Long only, multi-cap, sector agnostic strategy focusing on capturing the “trillion-dollar India opportunity”.

- Concentrated QGARP (quality growth companies at a reasonable price) portfolio

focusing on - Blend of large, mid & small cap (50:30:20) listed companies with niche core

competence & large opportunity size, proven track record & impeccable

management capabilities - Portfolio of 20-25 stocks; benchmarked against BSE 500 TRI

(E) Classification Portfolio of the Carnelian Capital Compounder Strategy

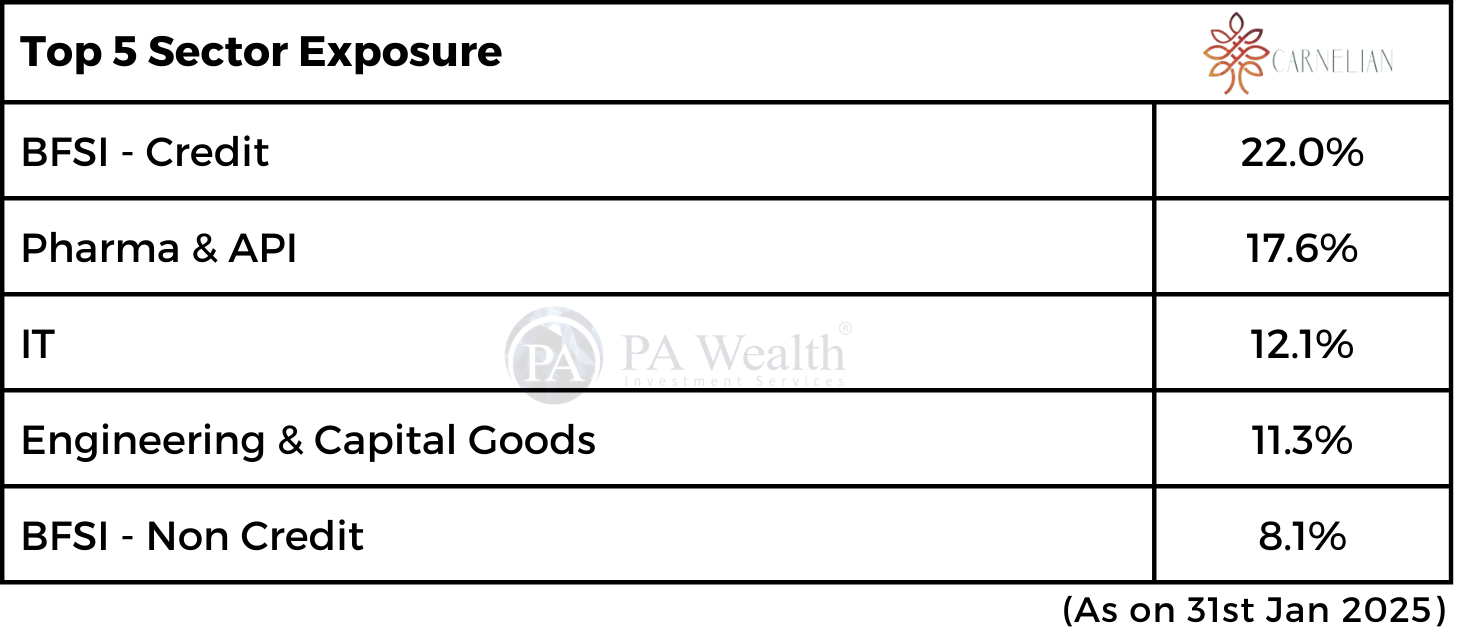

(i) Portfolio Mix by Market Cap Size

(ii) Top 5 Holdings of the fund

(iii) Top 5 Sectors Exposures

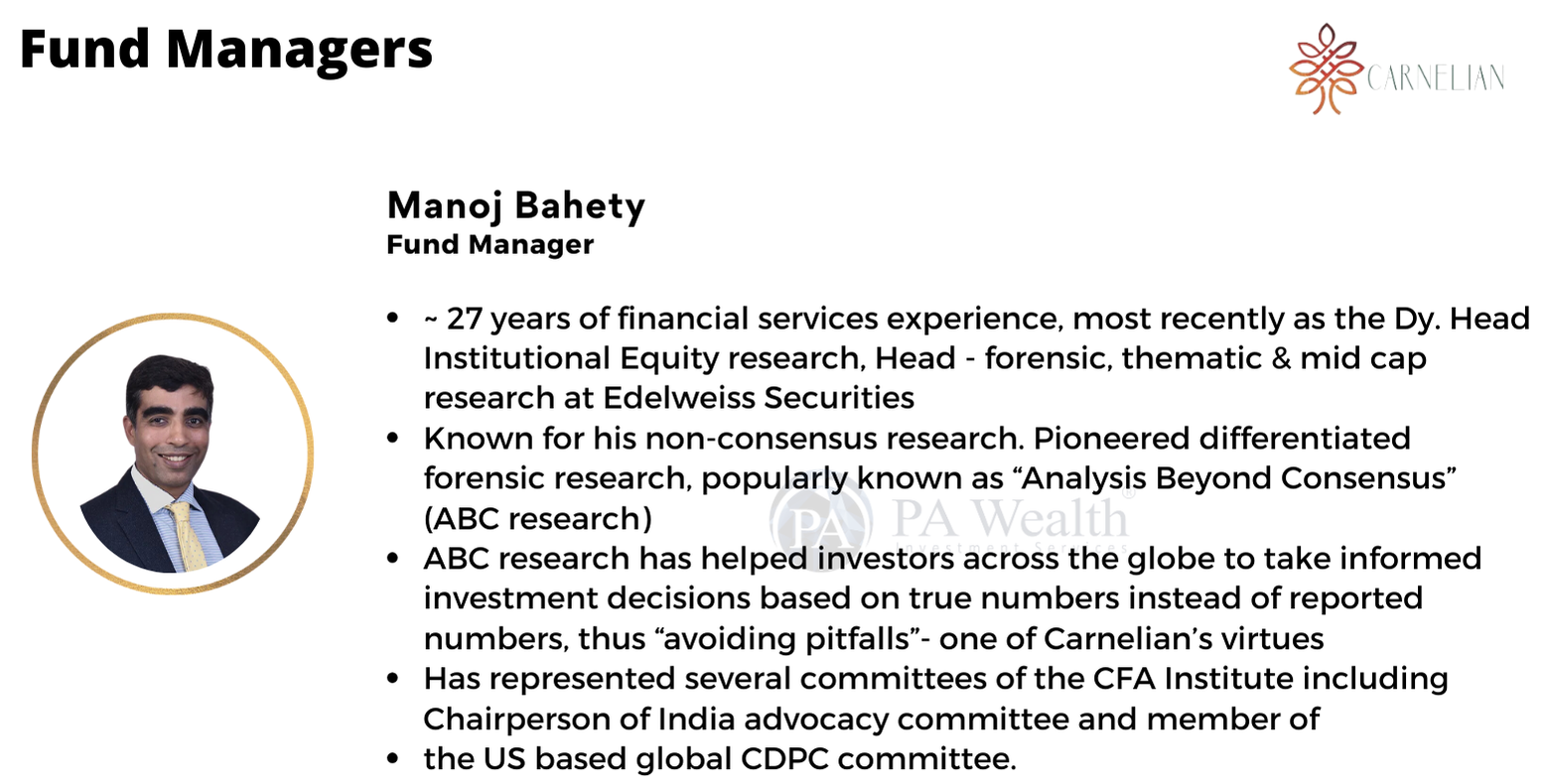

(D) Fund Managers & Tenure of managing the Scheme

(E) Carnelian Capital Compounder Strategy – Investment Details

| Carnelian Capital Compounder Strategy | |

|---|---|

| Minimum Investment | ₹ 50,00,000 (As on 31st Jan, 2025) |

| Exit load | 1 Year – 1% |

| Lock In | No |

| Expense Ratio | Fixed fee: 2.5% p.a. (As on 31st Jan, 2025) or Fixed AMC fee: 1.50% or 0.00% Hurdle: 8.00% Profit Sharing: 15% profit Sharing above 8% hurdle or 20% Profit Sharing above 8% Hurdle(with Catch up) |

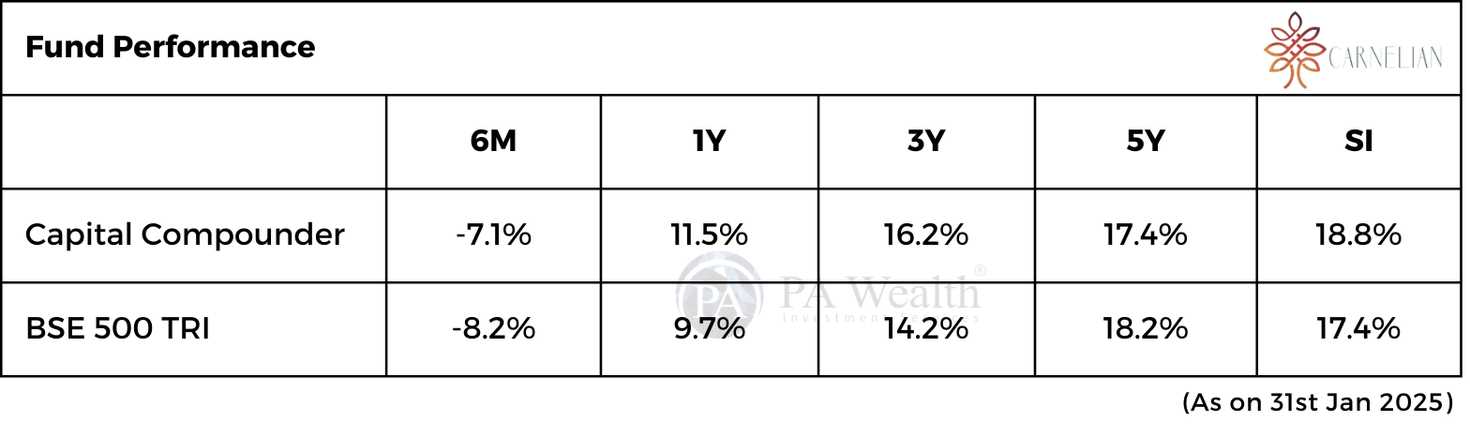

(F) Returns Generated By Carnelian Capital Compounder Strategy

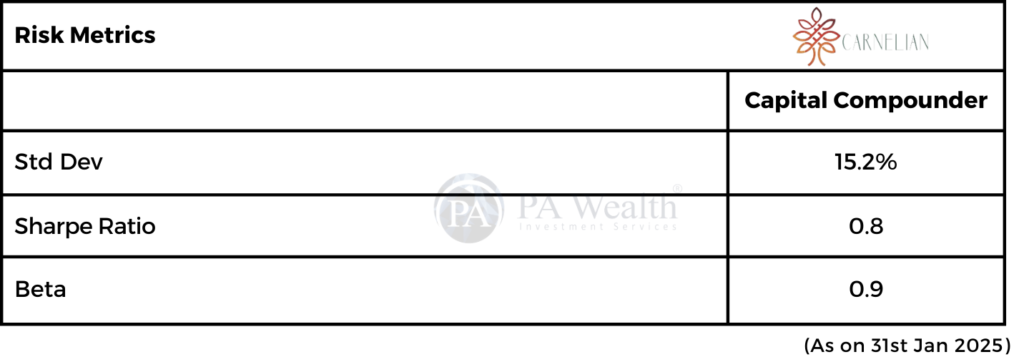

(G) Risk Metrics

(H) Taxability on earnings

Capital Gains Taxation

- If the stocks are sold after 1 year from the date of investment, gains upto Rs 1.25 lakh in a financial year are exempt from tax. Meanwhile, gains over Rs 1.25 lakh are tax at the rate of 12.5%.

- If the stocks are sold within 1 year from the date of investment, the entire amount of gain is taxed at the rate of 20%.

Dividend Taxation

Dividends are include in the income of the investors and taxed according to their respective tax slabs. Further, if an investor’s dividend income exceeds Rs. 5,000 in a financial year.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: PMS Bazaar, Industry’s Publications, News Publications, PMS Company, APMI, SEBI.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore