JSW Infrastructure Ltd stands as the second-largest private port operator in India, boasting a significant cargo handling capacity of 170 MTPA.

- About the company

- Journey Since Inception

- Board Members

- Indian Port Industry

- Shareholding Pattern

- Revenue Segments

- Operational Capacity

- Cost Structure

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

JSW Infrastructure, part of the JSW Group, provides maritime-related services including, cargo handling, storage solutions and logistics services. JSW Infrastructure Limited stands as the second-largest private port operator in India, boasting a significant cargo handling capacity of 170 MTPA. The company currently handle various types of cargo, including dry bulk, break bulk, liquid bulk, gases and containers. Handling cargo also include thermal coal, coal (other than thermal coal), iron ore, sugar, urea, steel products, rock phosphate, molasses, gypsum, barites, laterites, edible oil, LNG, LPG, and containers.

JSW Infrastructure ports and port terminals typically have long concession periods ranging between 30 to 50 years, providing the company with long-term visibility of revenue streams. The company has a presence across India with Non-Major Ports located in Maharashtra and port terminals located at Major Ports across the industrial regions of Goa and Karnataka on the west coast, and Odisha and Tamil Nadu on the east coast.

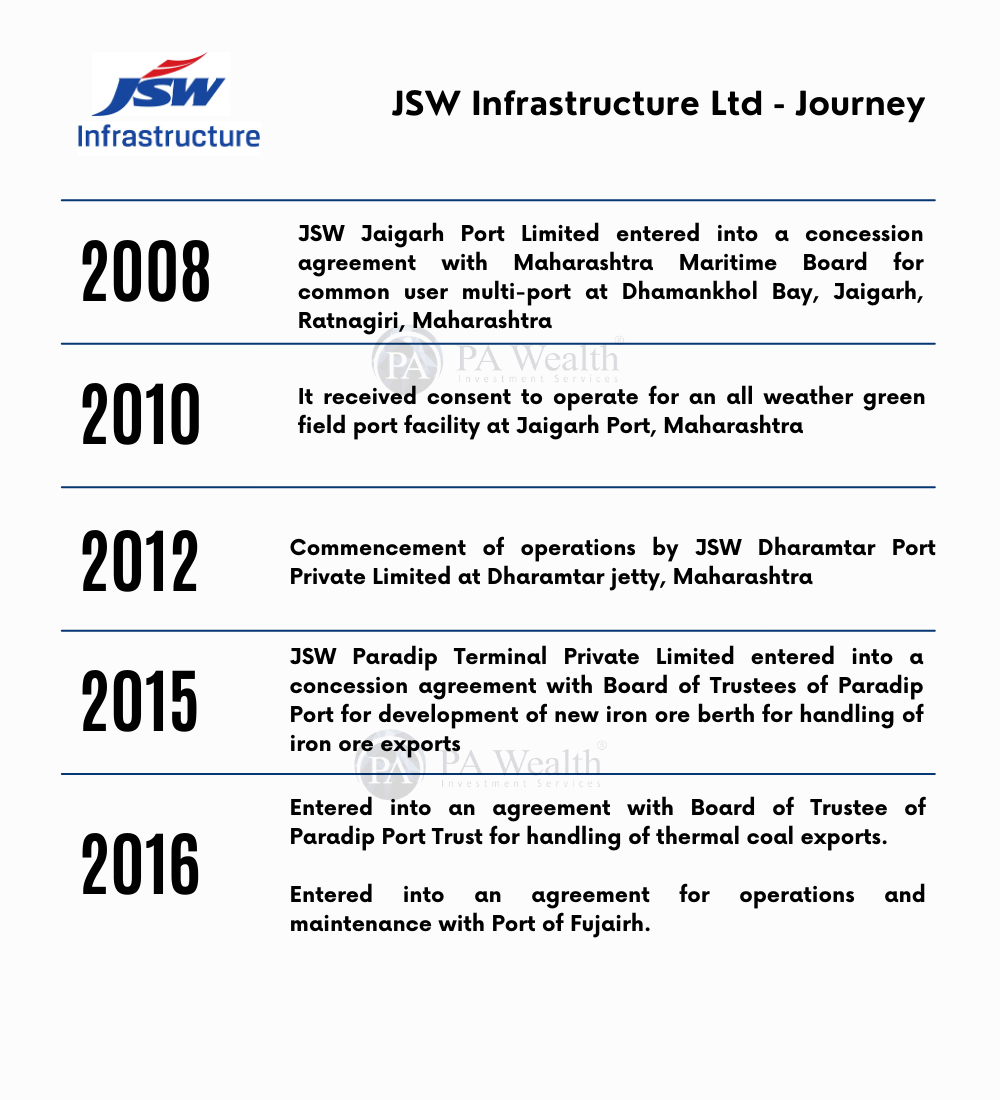

(B) Journey of JSW Infrastructure Limited

(C) Board of Directors of JSW Infrastructure Limited

(D) Indian Port Industry

Ports in India handle 90% by volume and 70% by value of India’s external trade. Indian Ocean encompasses about 1/5th of the world sea area and supports approx. 80% of global maritime oil trade. As reported by Niti Aayog in 2021, India’s logistics cost as a % of GDP stood around 14% compared to 10-11% for BRICS countries and 8-9% for developed countries.

Government rolled out the “Sagarmala” initiative in April 2016 by the Government Of India to reduce logistics costs for both domestic and export import cargo with optimized infrastructure investment of Rs. 5.48 lakh crores. As on April, 2024, India has 13 major and 205 non-major ports. Major ports are administered directly by the central government, whereas non-major ports fall under the state government.

(E) Shareholding Pattern of JSW Infrastructure Limited

(F) Revenue Segments

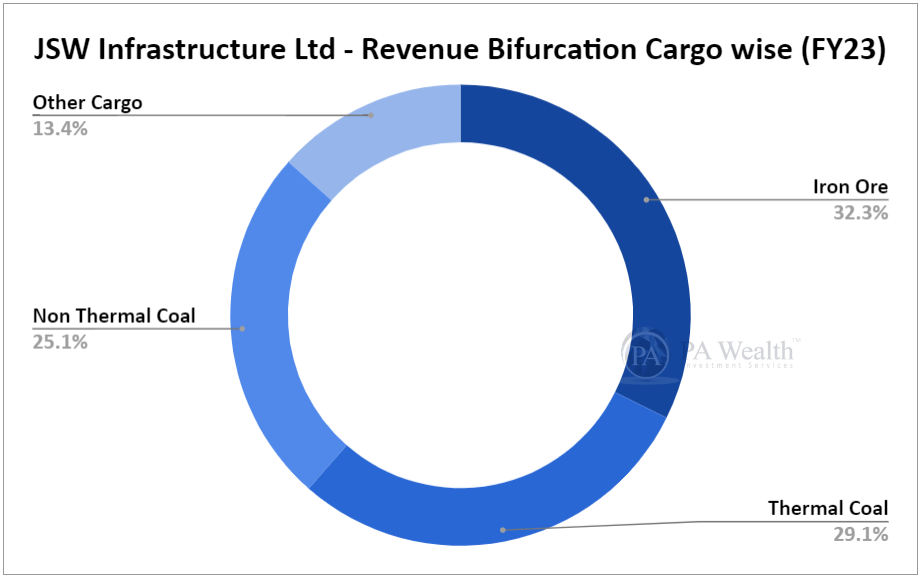

(i) Cargo wise Revenue

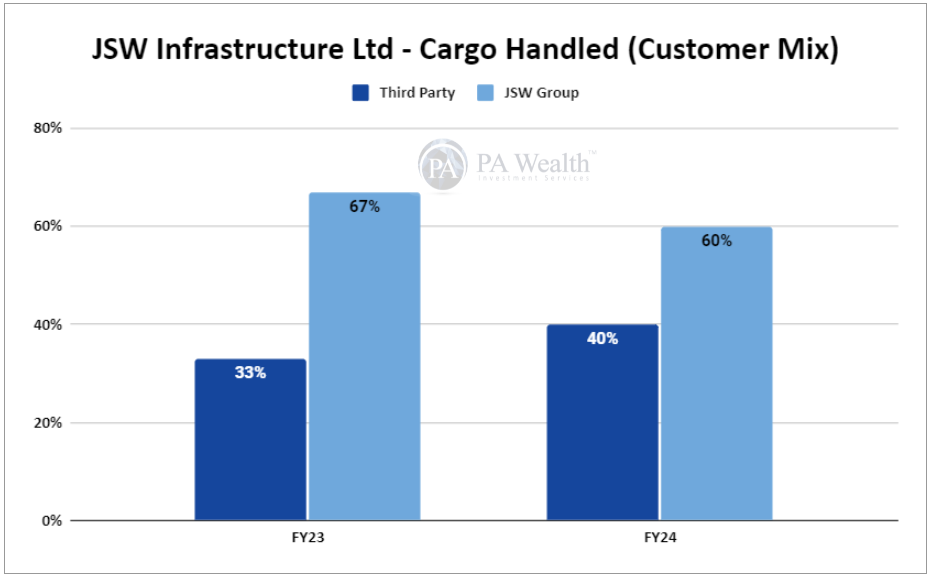

(ii) Cargo Handled (Customer Mix)

(F) Ports & Terminals Operational Capacity

It operates 10 in India and 2 port terminals under an Operational & Maintenance agreement with UAE with a total operational capacity of 170 MTPA.

(G) Cost Structure of LT Foods Limited

(H) Financials of JSW Infrastructure Limited

The company’s revenue has grown at a CAGR of 29.18% over the past 8 years, increasing from Rs 888 Cr. in FY17 to Rs 3,763 Cr. in FY24. Subsequently, the company’s PAT has also shown growth, rising from Rs 310 Cr. in FY17 to Rs 1,161 Cr. in FY24 at a CAGR of 19.33%. Furthermore, the company’s ROE has decreased from 16.70% in FY17 to 14.50% in FY24.

DuPont Analysis

(I) Management Discussion

- During the year company handle a cargo volume of 106 Mn Ton which is higher by 15% over the last year.

- Major ports in India have 50% of India’s port capacity and a significant portion of it is yet to be privatized.

- The Company is expecting around Rs 30,000 Cr of investment in the next 6 years to get its port capacity to 400 Mn Ton.

- Management expects a 10-12% growth for the next year and 15-17% growth in the long term.

- Company has increase its market share from 4% in FY18 to 6% in FY23.

- Company has reduce its Net-debt/EBITDA from 3.8x in FY22 to 0.03x in Q4FY24.

- 3rd Party Cargo share to the overall customer has increased from 37% to 46%.

Growth Drivers

- Strong demand from JSW sister companies will support volumes over the medium term.

- Scope to increase capacity utilization by adding new services & 3rd party volumes.

- Demand from manufacturing through Make in India, Atmanirbhar Bharat and PLI bodes well for merchandise trade and augurs well for container trade.

Maritime India Vision 2030

In Feb, 2021 Ministry of Port, Shipping& Waterways released a maritime India vision 2030 report under the Government Sagarmala program. It aims to invest 3 lakhs Cr to 3.5 lakhs Cr across ports, shipping, and inland waterways categories. This vision roadmap is estimated to help unlock Rs 20,000+ Cr worth of potential annual revenue.

(J) Strengths & Weaknesses of JSW Infrastructure Limited

Strengths

(i) Geographically-diversified port locations:

JSW Infrastructure ports are favourably located in the vicinity of the JSW group companies, with Paradip terminal located near the coal and iron ore mines in Orissa and the Ennore, Mormugao and Mangalore terminals near the plants of JSWSL in Vijaynagar and Salem and the Nandyal plant of JSW Cement.

(ii) Favourable industry outlook:

Overall cargo throughput at Indian ports is at its all-time peak at 1,433 MMT in FY23. The cargo throughput has shown a growth rate (CAGR) of ~3% from FY19 to FY23 in Ports industry. Annual cargo growth of 4-5% for FY24 to FY27 led by the increasing trend of containeri zation in India.

Weaknesses

(i) Project execution risk for the underlying capex:

JSWIL has planned a brownfield expansion capex of approximately ₹1,200 over the next three years at Jaigarh Port and Mangalore Container Terminal. It has also received a letter of award for developing a greenfield port at Keni, Karnataka with an outlay of approximately ₹5,000 crore from FY25-FY29.

(ii) Competition from nearby ports & terminals and concentrated cargo mix:

JSWIL faces competition from the minor ports on the eastern and western coast. Its terminals at major ports also face high competition from other terminals located on the same port. This large proportion of group cargo exposes JSWIL to inherent risk related to decline in cargo handling rates through renegotiation of contracts or bulk discounts.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in In